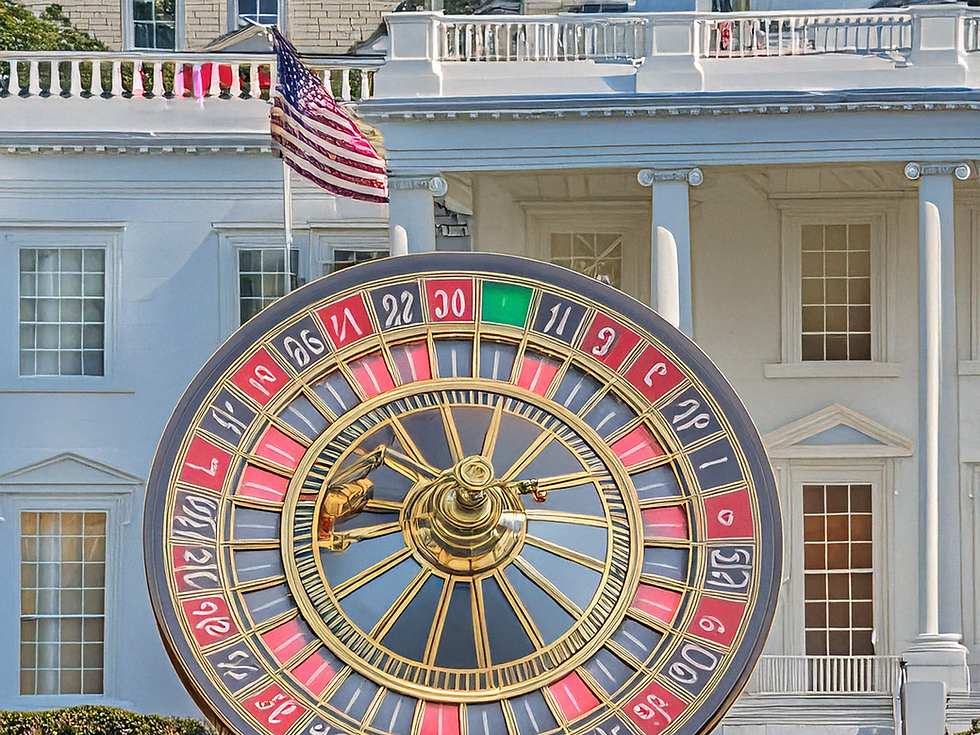

Stock Market to Be Replaced by a Giant Roulette Wheel for Transparency

- Wynn Lose

- Feb 8, 2025

- 2 min read

By Wynn Lose, Senior Financial Correspondent

NEW YORK — In a bold move to increase transparency and eliminate the illusion of market stability, financial regulators have announced that the entire stock market will be replaced by a single giant roulette wheel.

The decision comes after years of speculation that stock trading is essentially legalized gambling, with high-frequency algorithms and insider trading making it nearly impossible for the average investor to succeed. Officials say the change will at least make things more honest.

“People like to pretend investing is about logic and strategy,” said SEC spokesperson Chip Stake. “But let’s be real—most of it is just blind luck and hoping someone dumber buys in after you. So why not cut out the middleman and just spin a wheel?”

How It Will Work

The new Wall Street Roulette™ system will replace traditional stock exchanges, such as the NYSE and NASDAQ, with a single, giant roulette wheel located in Times Square.

• Every morning, investors will line up to place bets on their favorite companies.

• Instead of quarterly earnings reports, CEOs will simply spin the wheel to determine their stock price.

• The SEC has confirmed there will be no insider trading, as even the insiders won’t know what’s going to happen.

A More Honest Market

Financial analysts say the change will bring much-needed transparency to investing.

“For years, the stock market has been rigged in favor of hedge funds, billionaires, and algorithmic traders,” said economist Penny Flip. “Now, finally, the average person has the same odds as everyone else—which are still terrible, but at least they know it.”

Despite the skepticism, some of Wall Street’s biggest names are embracing the shift. JP Morgan and Goldman Sachs have already rebranded their investment teams as ‘professional roulette consultants,’ and Robinhood is offering commission-free spins with every deposit.

Critics Remain Skeptical

Not everyone is on board with the plan. Some economists worry that a completely random financial system could lead to instability.

“This is reckless,” said former Federal Reserve Chair Bill O’Bankrupt. “We spent decades pretending the market was based on fundamentals. If people realize it’s all just chance, they might stop believing in it entirely.”

Supporters, however, argue that this might be the most stable the market has ever been.

“At least now, when your life savings vanish overnight, you’ll know it was bad luck and not a billionaire shorting your future,” said retail investor Lisa Gamble.

Final Spin

With the stock market increasingly resembling a casino anyway, experts say this may be the most honest thing Wall Street has ever done.

At press time, the Dow Jones had just landed on “double zero”, wiping out an entire day’s gains.

Comments